Find Potential New Castle CountyDelaware Senior Tax Discount& Property Tax Exemption

Note: Analysis based on current recipients - actual eligibility may vary.

2025 Application Deadlines Have Passed

Important: Application windows for 2025 tax relief have closed (deadlines were April 30th and June 1st). These programs will be available again in 2026 with the same deadlines. Review now to plan ahead for next year's applications.

Delaware Senior School Credit

- • 50% credit on school taxes up to $500 annually

- • Age 65+ Delaware residents

- • No income limits

- • State-funded (no cost to others)

- • Deadline: April 30th annually

NCC Senior Discount (County)

- • $173,000 county + $32,000 school exemptions

- • Age 65+ New Castle County residents

- • County: Income under $65K (excluding Social Security)

- • School: Income under $15K/$19K

- • Deadline: June 1st annually

Common questions about New Castle County senior tax exemptions, Delaware property tax relief for seniors, and NCC senior discount eligibility

How to Check Your Current Tax Bill

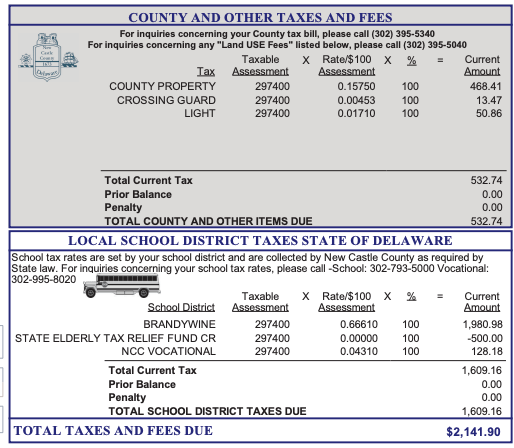

✅ Example 1: Getting $500 School Credit Only

Look for these key signs on your tax bill:

- •County and School taxable values are identical AND equal your assessed value

(Property assessed at $297,400, County taxable = School taxable = $297,400) - •School section shows:

“STATE ELDERLY TAX RELIEF FUND CR” with -$500.00 - •No county exemption applied:

You're paying county tax on the full assessed value (no reduction)

💡 Opportunity: You may qualify for additional county savings of $280-$320+ annually!

Sample Tax Bill:

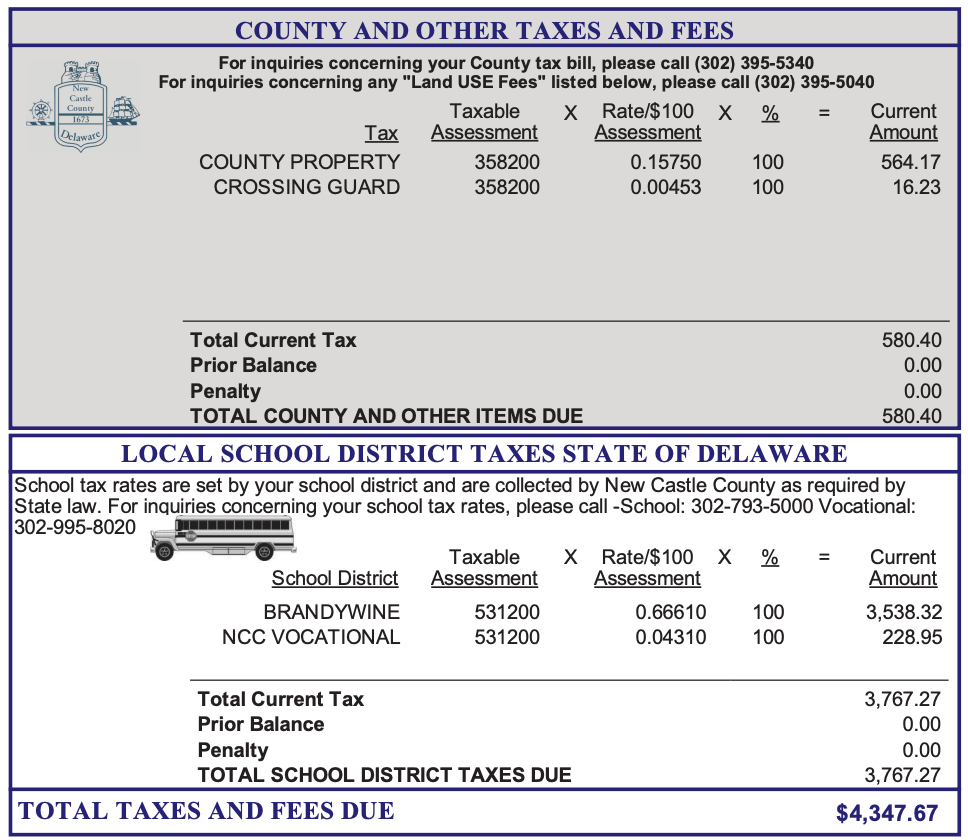

📋 Example 2: Getting County Credit Only

Look for these key signs on your tax bill:

- •County taxable is LOWER than school taxable

(County and School differ, showing county exemption is applied) - •School section shows NO credit line:

No “STATE ELDERLY TAX RELIEF FUND CR” appears - •County exemption only:

You're getting the county savings but missing the $500 school credit

💡 Opportunity: You may qualify for an additional $500 school credit!

Sample Tax Bill:

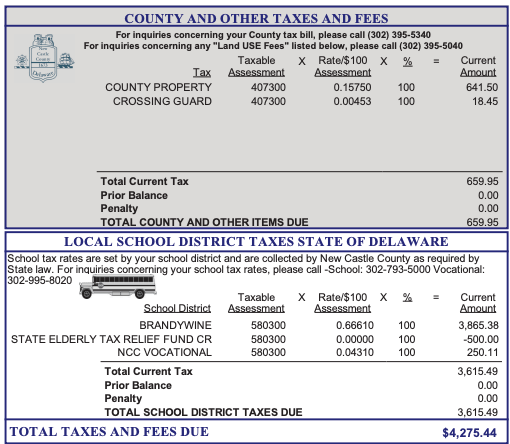

✅ Example 3: Getting Both Credits (Maximized)

Look for these key signs on your tax bill:

- •County taxable is LOWER than school taxable

(County: $407,300 vs School: $580,300 - a $173,000 difference) - •School section shows:

“STATE ELDERLY TAX RELIEF FUND CR” with -$500.00 - •County exemption applied:

The $173,000 difference shows your county exemption amount

🎉 Excellent: You're maximizing your senior tax savings!

Sample Tax Bill:

Q: Does New Castle County Delaware offer senior property tax discounts?

Yes! New Castle County Delaware offers significant senior tax discounts including the $500 Delaware Senior School Property Tax Credit and the NCC senior discount (up to $173,000 assessed value reduction). These New Castle County senior tax exemptions can save hundreds annually for Delaware senior citizens.

Q: What New Castle County senior tax exemptions are available in Delaware?

New Castle County Delaware offers multiple senior tax exemptions: 1) The $500 Delaware Senior School Property Tax Credit (age 65+, no income limits), 2) The NCC senior discount for elderly residents (up to $173K assessed value reduction, income under $65K), and 3) An additional school exemption (up to $32K assessed value reduction, very low income). Most qualify for the first two programs.

Q: How do I apply for New Castle County Delaware senior tax relief?

To get New Castle County Delaware senior tax relief, apply annually by June 1st. For the $500 school credit, you need to be 65+ and a Delaware resident. For the NCC senior discount, you also need income under $65,000/year (excluding Social Security). Contact the New Castle County Assessment Division at (302) 395-5520 for applications.

Q: Who pays for these New Castle County senior tax exemptions?

The $500 Delaware Senior School Property Tax Credit is funded by the State of Delaware - it does not increase taxes for other residents. However, the NCC senior discount (county exemption) is paid for by all other New Castle County residents through slightly higher tax rates.

Q: I'm getting the $500 school credit. What else can I get?

If your county and school taxable values are the same on your bill, you may qualify for the NCC Elderly Exemption, which can reduce up to $173,000 from your assessed value. This typically saves $280-$320+ annually in county taxes.

Q: What if I don't file federal taxes?

You can still apply! Instead of tax returns, you'll need Social Security benefit statements and any other income documentation. Contact the Assessment Division at (302) 395-5520 for guidance on alternative documentation.

Q: Can I apply if I live in assisted living but own my home?

Yes! You can qualify if you moved to a care facility due to infirmity but still own the property as your principal residence. You'll need documentation from your healthcare provider.

Q: I applied before and was denied. Can I try again?

Absolutely! Your financial situation may have changed, or there may have been documentation issues. Income limits: $65,000/year (excluding Social Security) for county exemption. The $500 School Credit has no income limits - only age (65+) and residency requirements.

Q: When should I apply for 2026 credits?

Applications typically open in early spring with a June 1st deadline. Start gathering documents (2025 tax returns, Social Security statements) in January. We'll send email reminders when forms become available.

Q: What happens if my income changes after I'm approved?

You must notify the county if your income exceeds the limits or if you no longer meet other requirements. However, small fluctuations in Social Security or pension income typically don't affect eligibility.

Q: How can I tell if I have the $500 school credit on my tax bill?

Look for “STATE ELDERLY TAX RELIEF FUND CR” with -$500.00 in the school district section of your tax bill. If your county and school taxable values are equal to your assessed value, you have the school credit but no county exemption.

Q: How can I tell if I have both the school credit and county exemption?

You have both credits when: (1) Your county taxable value is lower than your school taxable value, and (2) You see “STATE ELDERLY TAX RELIEF FUND CR” with -$500.00 in the school section. The difference between county and school taxable shows your exemption amount.